For every Accountant out there, Nickzom Calculator (The Calculator Encyclopedia) can help you get answers to calculations in accounting that can influence your capital investment decision.

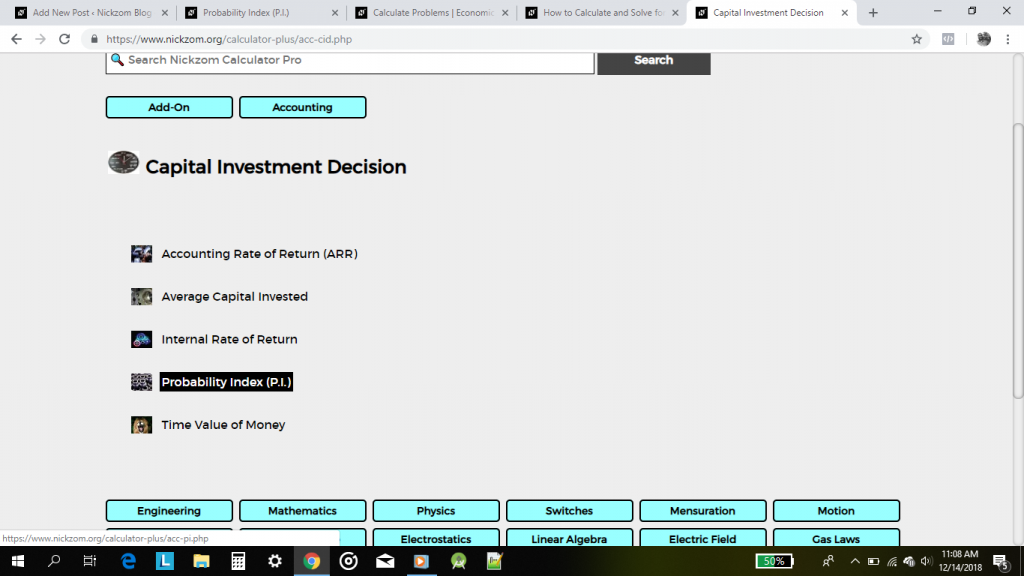

The primary capital investment decisions are:

- Accounting Rate of Return

- Average Capital Invested

- Internal Rate of Return

- Probability Index

- Time Value of Money

As an accountant presenting a report to a firm or for research purposes in a means to influence the decision for capital investment. A proper knowledge and accurate result of the calculations would factor in majorly.

You might be wondering how can I get this Nickzom Calculator and access this functionality?

You can access Nickzom Calculator via any of these means:

Web – https://www.nickzom.org/calculator-plus

Android (Paid) – https://play.google.com/store/apps/details?id=org.nickzom.nickzomcalculator

Apple (Paid) – https://itunes.apple.com/us/app/nickzom-calculator/id1331162702?mt=8

How to Calculate Capital Investment Decision Metrics with Nickzom Calculator

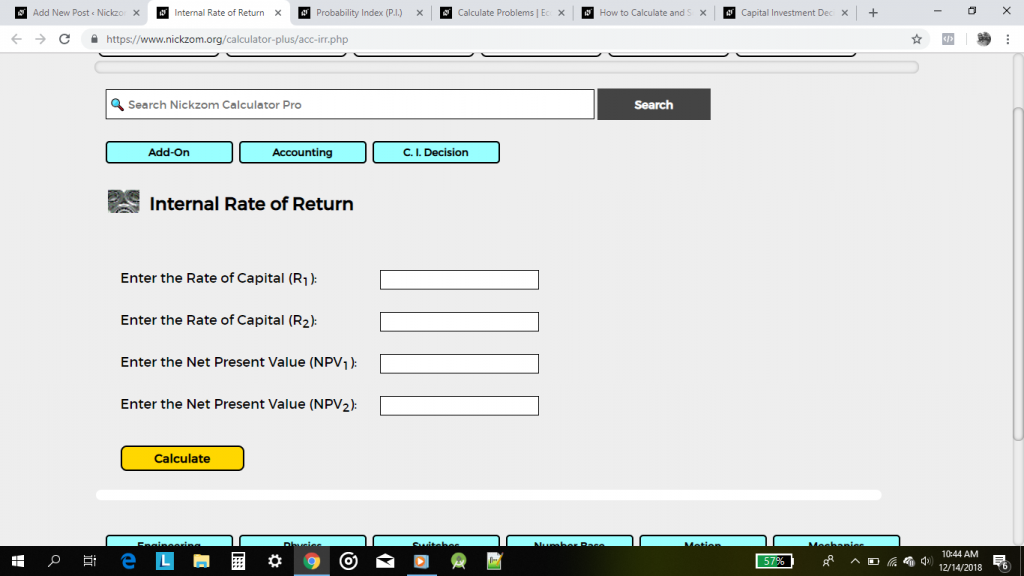

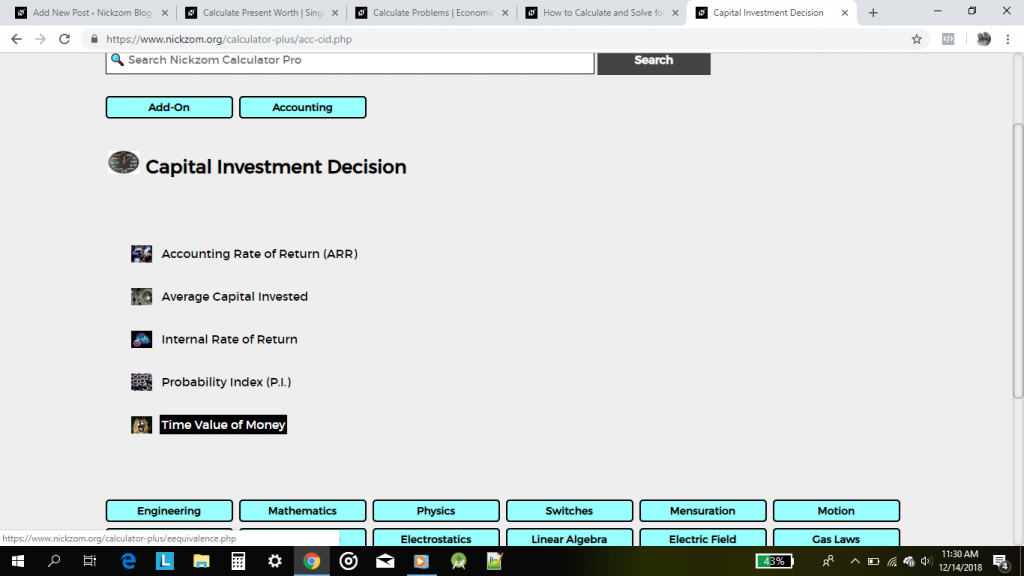

Once you have got the software, proceed to the Calculator Map, then click on Accounting under the Add-On section.

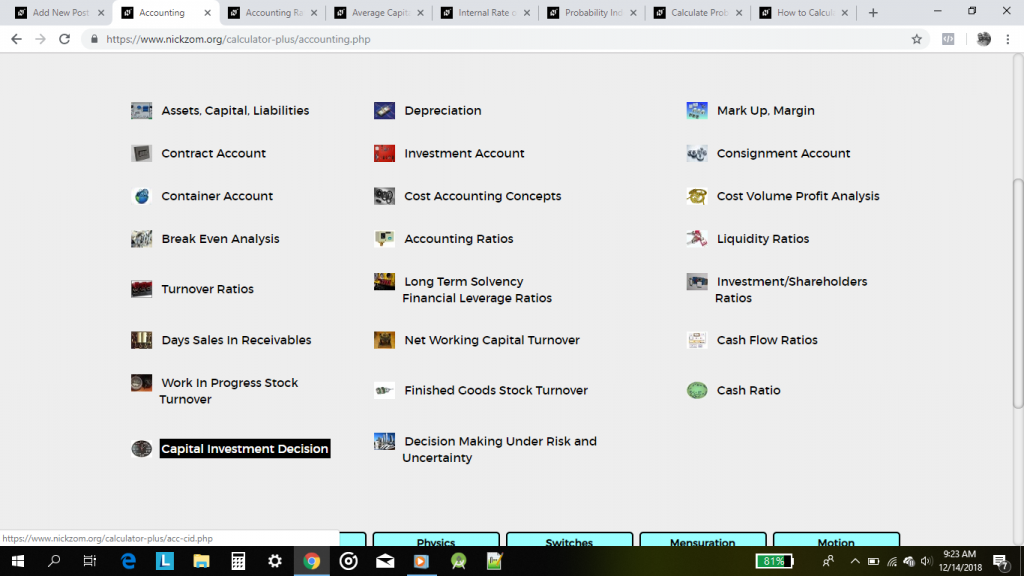

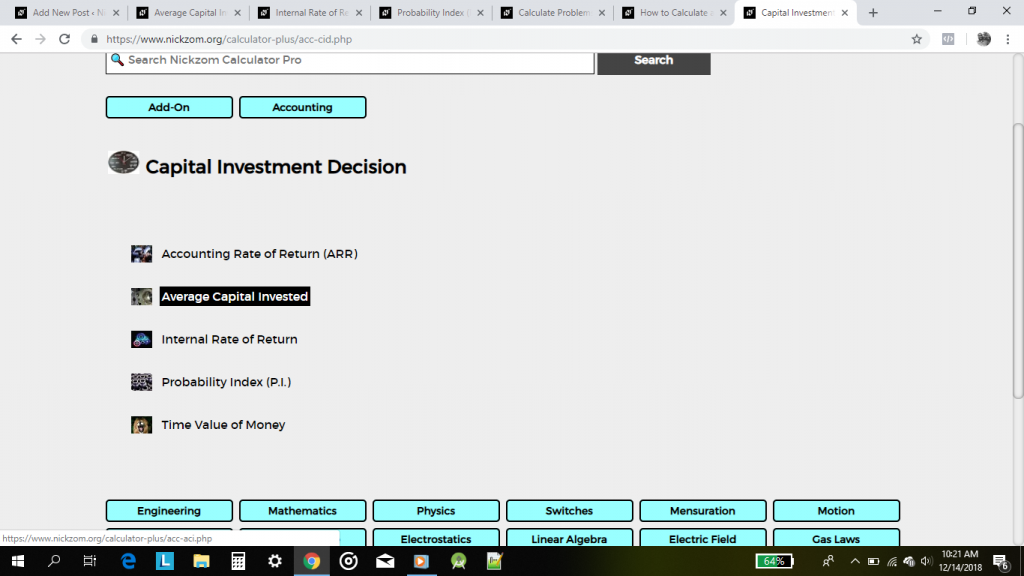

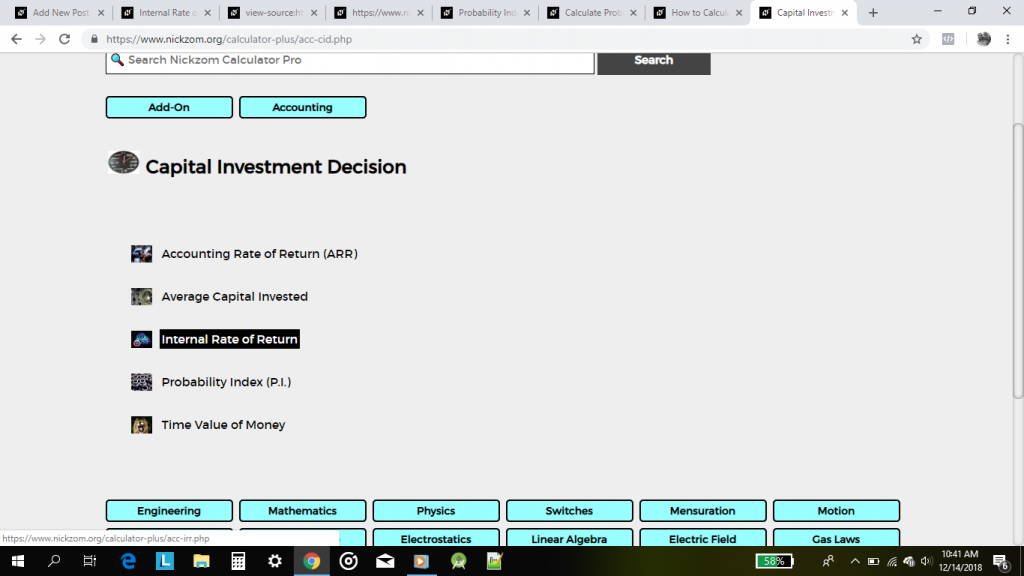

Then, click on Capital Investment Decision in the Accounting category.

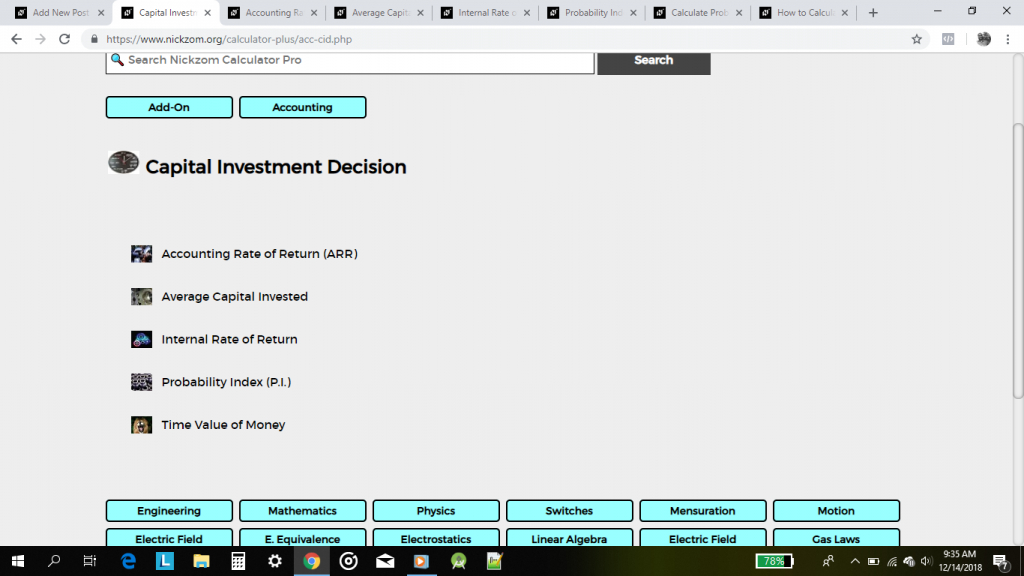

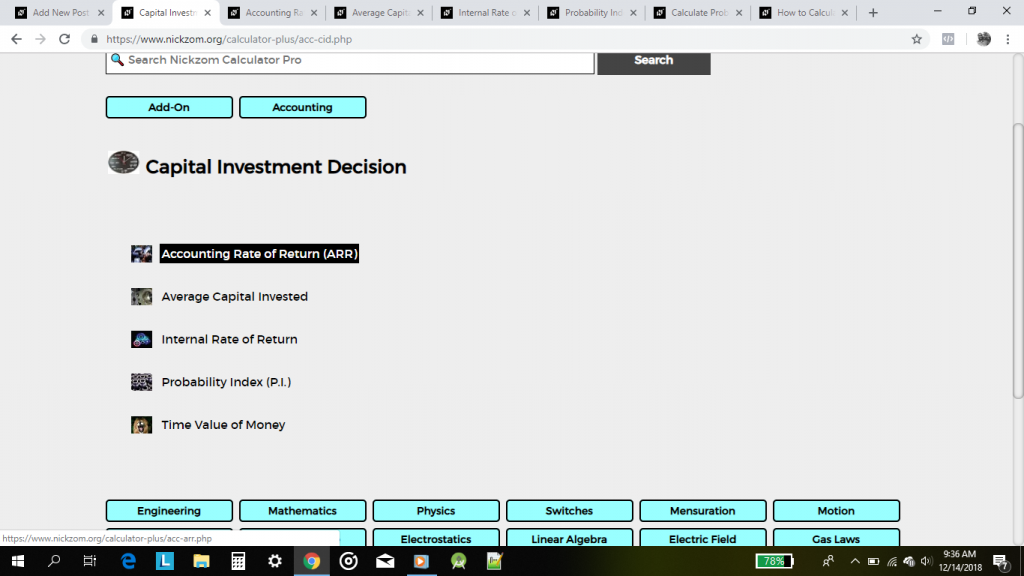

Clicking on Capital Investment Decision would result to this page.

Accounting Rate of Return

To calculate the accounting rate of return there are two parameters that needs to be given to get a result or answer. These parameters are:

- Average Annual Accounting Profit after Depreciation and Tax

- Initial Capital Invested

The representation of accounting rate of return is preferably in percentages (%).

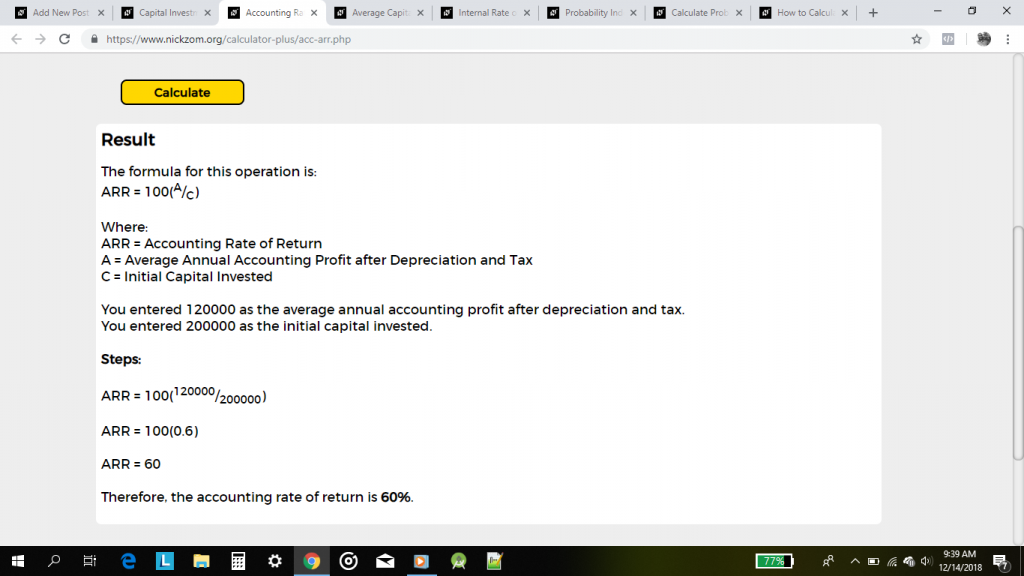

The formula for calculating the accounting rate of return is:

ARR = (A / C) X 100%

Where:

ARR = Accounting Rate of Return

A = Average Annual Accounting Profit after Depreciation and Tax

C = Initial Capital Invested

For Example: What is the accounting rate of return when the average annual accounting profit after depreciation and tax is $120,000 and the initial capital invested is $200,000.

To solve this problem is quite simple since all the parameters is given.

A = $120,000

C = $200,000

ARR = (120000 / 200000) x 100%

ARR = (0.6) x 100%

Therefore, ARR = 60%

Then, the accounting rate of return for the example is 60%.

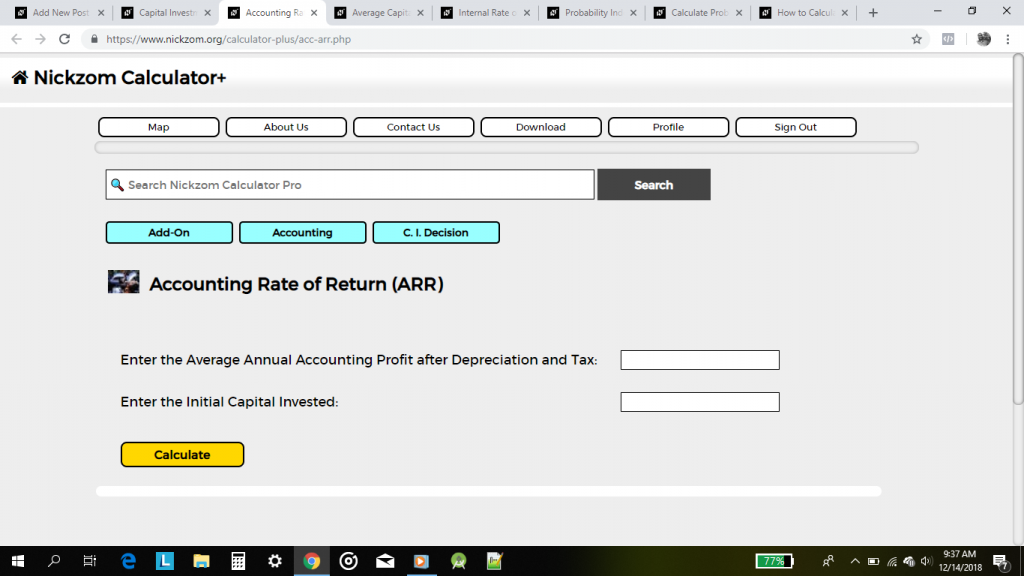

Using Nickzom Calculator, click on Accounting Rate of Return

Clicking on the link and displays the parameters and an input box for you to enter your values accordingly.

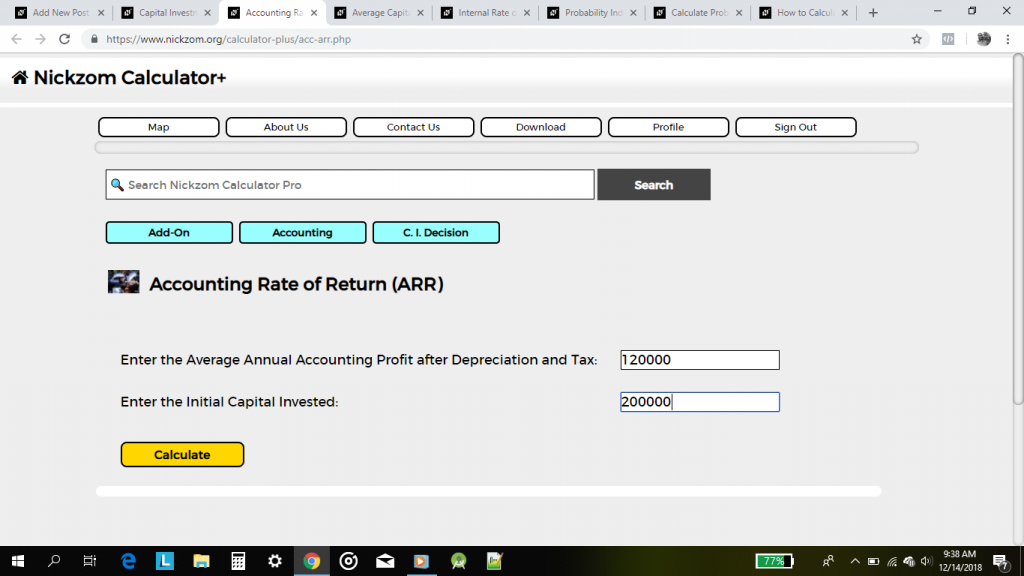

Enter the values as stipulated in the example.

Lastly, click on the Calculate button.

Average Capital Invested

Calculating for the average capital invested is necessary and requires two parameters which are:

Master Calculations Instantly

Unlock solutions for math, physics, engineering, and chemistry problem with step-by-step clarity. No internet required. Just knowledge at your fingertips, anytime, anywhere.

- Scrap Value

- Initial Capital Invested

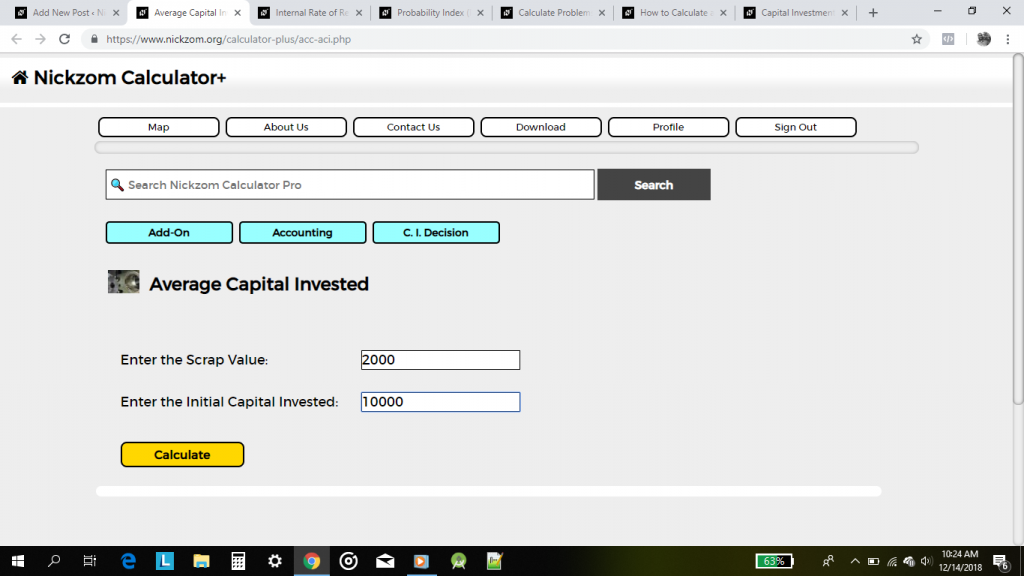

For Example: What is the average capital invested where the scrap value is $2,000 and the initial capital invested is $10,000.

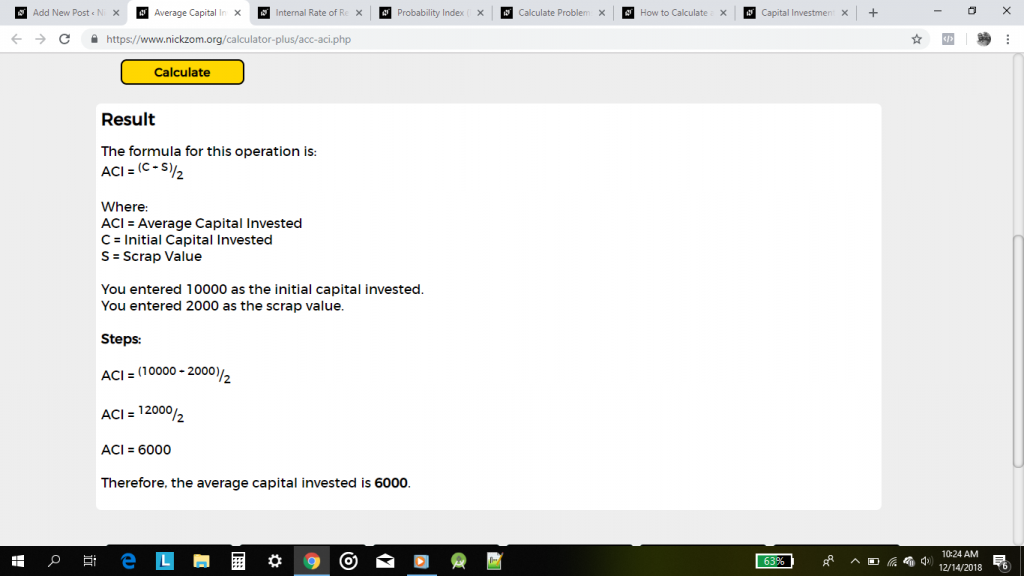

The formula for calculating the average capital invested:

ACI = (C + S) / 2

Where:

ACI = Average Capital Invested

C = Initial Capital Invested

S = Scrap Value

Therefore,

ACI = (10000 + 2000) / 2

ACI = (12000) / 2

Then, ACI = 6000

Therefore, the average capital invested is $6,000.

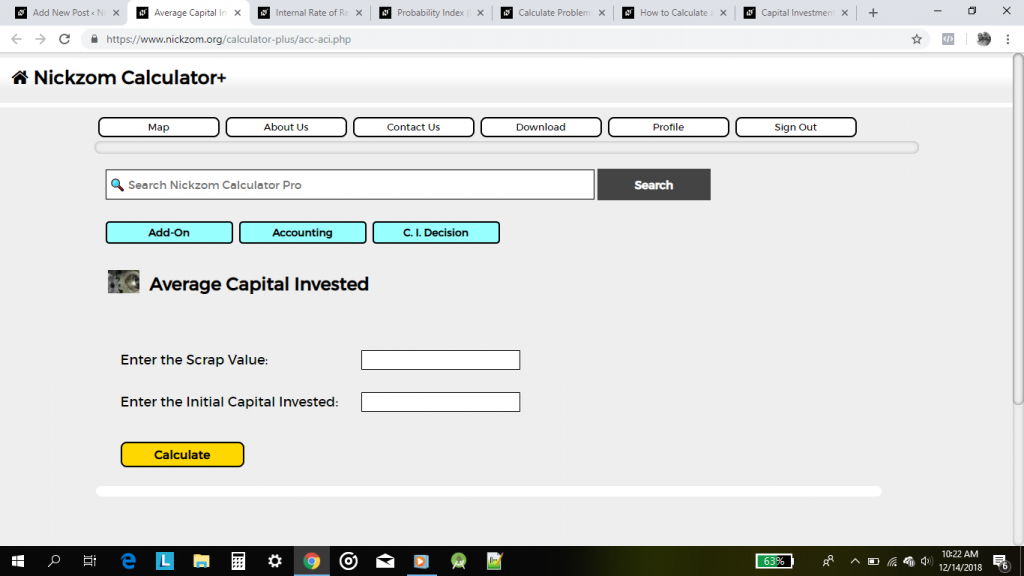

Using Nickzom Calculator, click on Average Capital Invested in the Capital Investment Decision Page

Clicking on the link would display the parameters needed to calculate for the average capital invested with an input box for their respective values

Now, enter the values appropriately

Lastly, click on the Calculate button

Internal Rate of Return

A lot of accountants get confused while trying to calculate the internal rate of return of a capital investment. If you are one of those accountants, do not worry we have got you covered, assured and protected.

There are 4 most required parameters when computing the internal rate of return and these parameters are:

- Initial Rate of Capital

- Final Rate of Capital

- Initial Net Present Value

- Final Net Present Value

For Example: What is the internal rate of return where the initial rate of capital is 10, final rate of capital is 20, initial net present value is $3,000 and final net present value is $5,000.

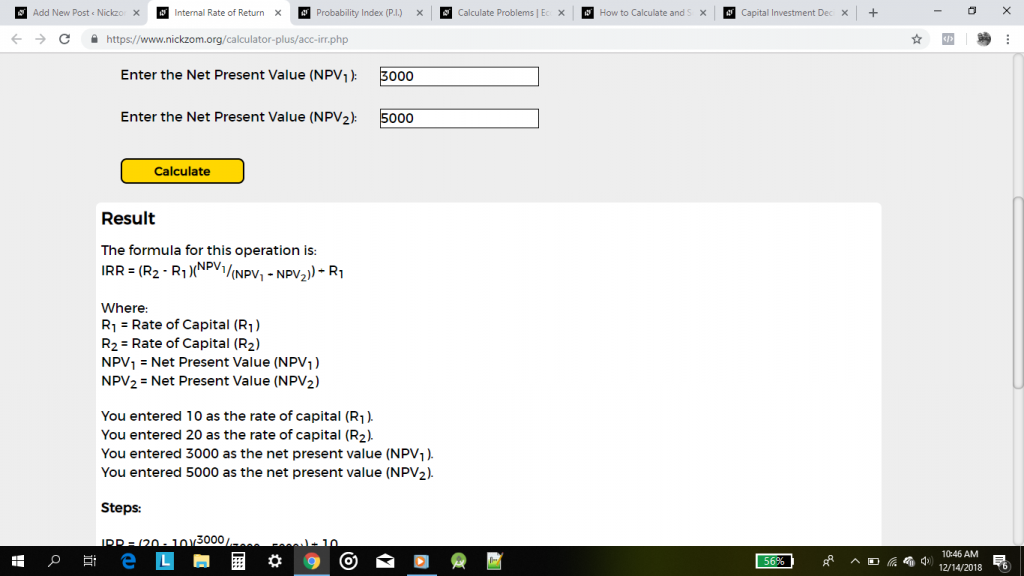

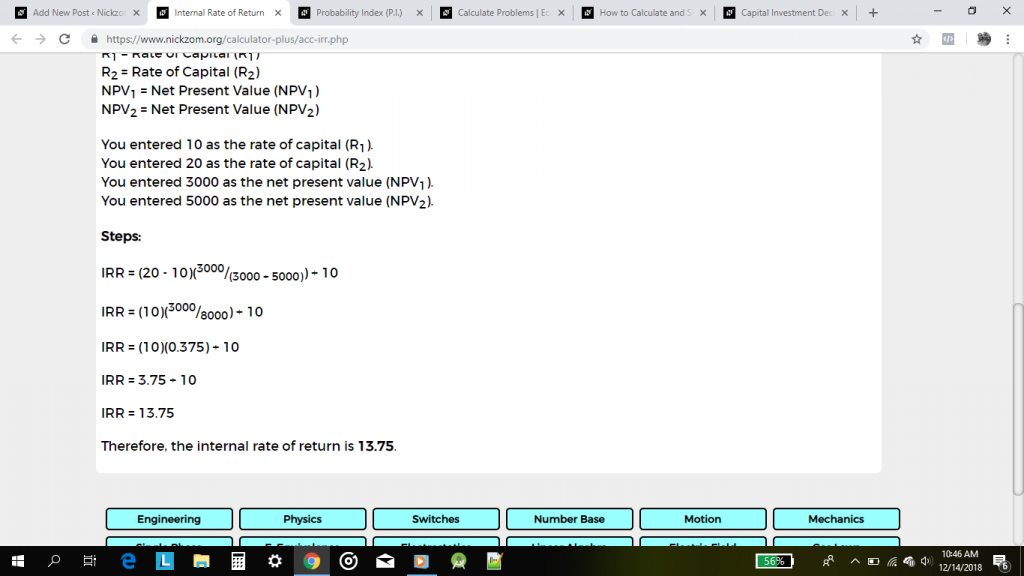

The formula for computing the internal rate of return is:

IRR = (R2 – R1)(NPV1/(NPV1 + NPV2)) + R1

Where

IRR = Internal Rate of Return

R1 = Initial Rate of Capital

R2 = Final Rate of Capital

NPV1 = Initial Net Present Value

NPV2 = Final Net Present Value

Therefore,

IRR = (20 – 10)(3000/3000 + 5000) + 10

IRR = (10)(3000/8000) + 10

That is, IRR = (10)(0.375) + 10

So, IRR = 3.75 + 10

Therefore, IRR = 13.75

This implies that the internal rate of return for the example is 13.75.

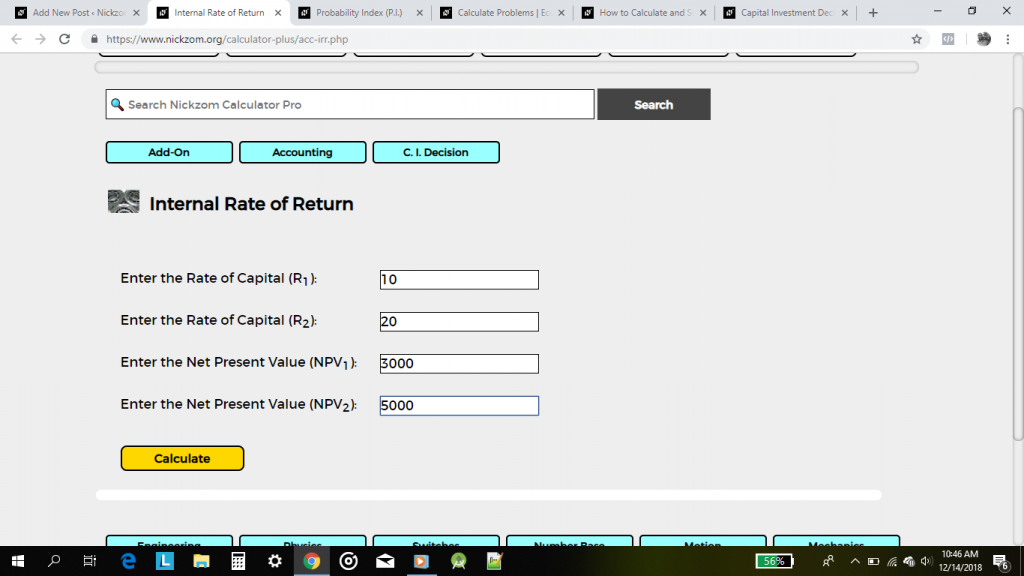

Using Nickzom Calculator, makes this computation easier, first click on Internal Rate of Return on the Capital Investment Decision page

A page would display the parameters and an input box to enter the values.

Now, key in the values for the parameters accordingly

Master Calculations Instantly

Unlock solutions for math, physics, engineering, and chemistry problem with step-by-step clarity. No internet required. Just knowledge at your fingertips, anytime, anywhere.

Lastly, click on the Calculate button

Probability Index in Capital Investment with Nickzom Calculator

According to Investopedia, the profitability index is an index that attempts to identify the relationship between the costs and benefits of a proposed project through the use of a ratio.

According to Wikipedia, Profitability index (PI), also known as profit investment ratio (PIR) and value investment ratio (VIR), is the ratio of payoff to investment of a proposed project. It is a useful tool for ranking projects because it allows you to quantify the amount of value created per unit of investment.

Rules for selection or rejection of a project:

- If PI > 1 then accept the project

- If PI < 1 then reject the project

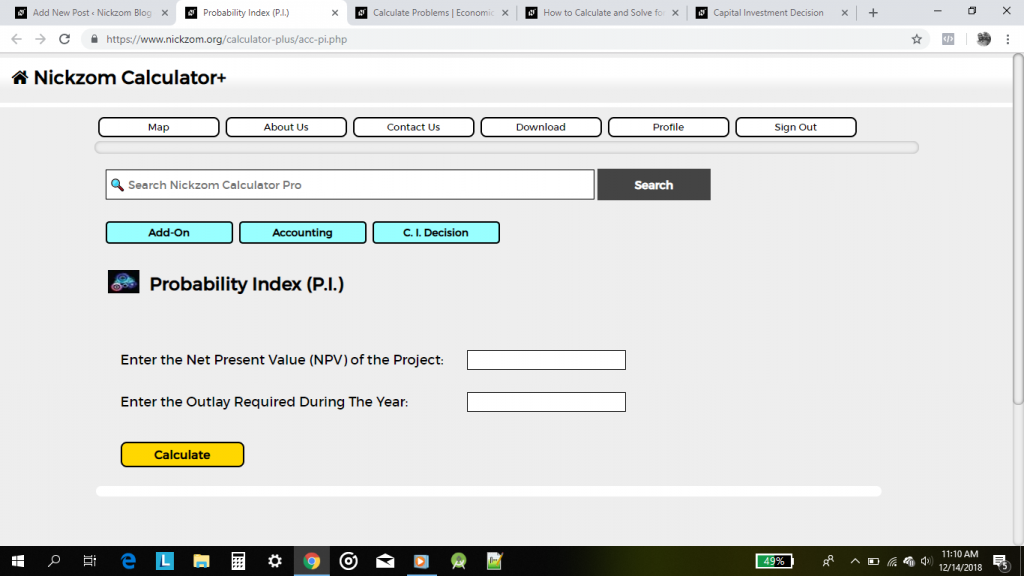

There are two essential parameters required for calculating the probability index and these parameters are:

- Net Present Value of the Project

- Outlay or Initial Investment Required during the Year

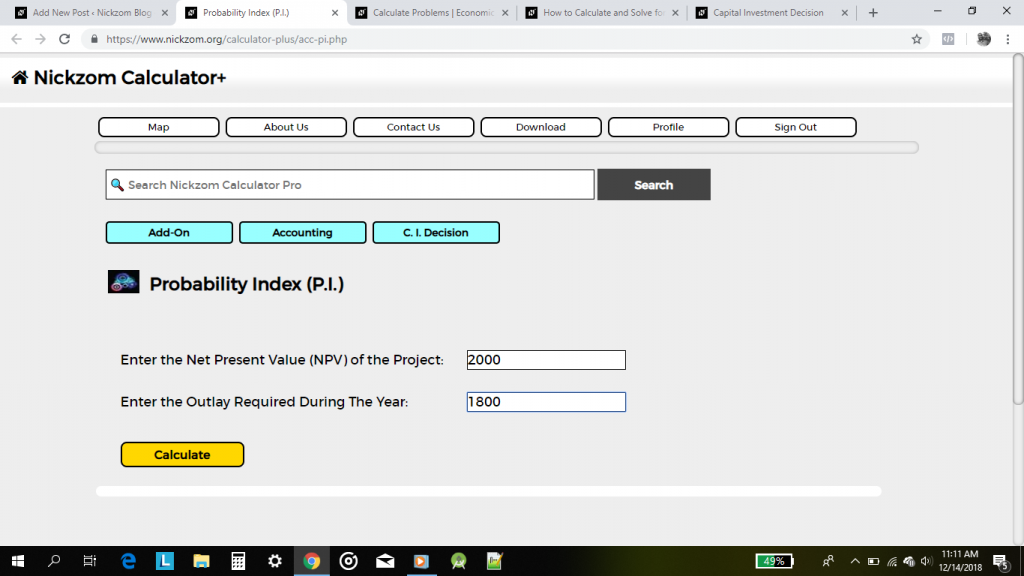

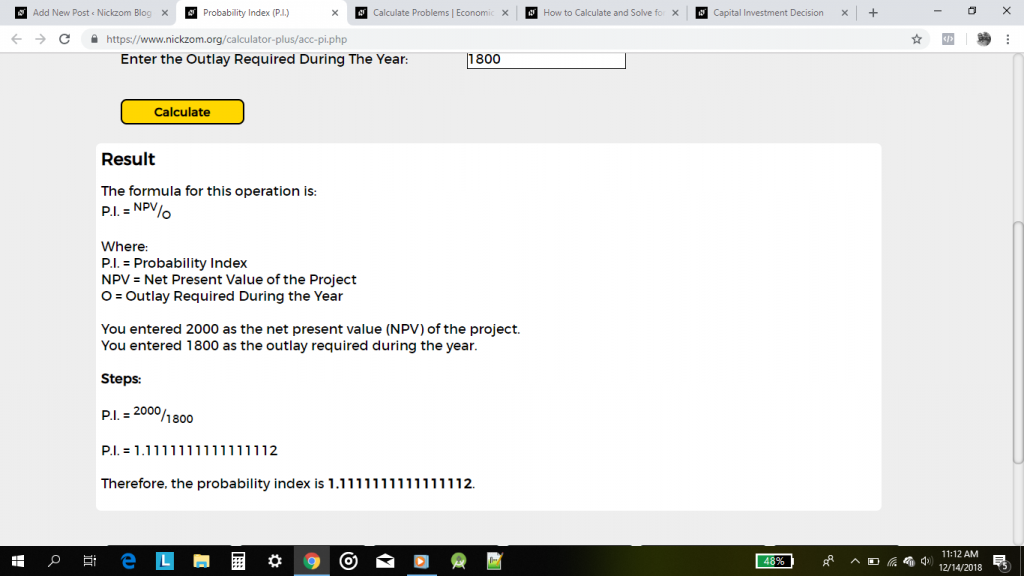

For Example: What is the probability index of a project where the net present value is $2,000 and the outlay or initial investment is $1,800.

The formula for calculating the probability index is:

PI = PV / I

Where:

PI = Probability Index

PV = Net Present Value of the Project

I = Initial Investment or Outlay

Therefore,

PI = 2000 / 1800

PI = 1.1111

So, the probability index is 1.1111.

Using Nickzom Calculator, click on Probability Index on the Capital Investment Decision.

On clicking the link, a page would be displayed showing the parameters for calculating the probability index

Now, enter the values accordingly.

Lastly, click on Calculate

Time Value of Money

According to Investopedia, the time value of money (TVM) is the concept that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity. This core principle of finance holds that, provided money can earn interest, any amount of money is worth more the sooner it is received. TVM is also sometimes referred to as present discounted value.

Time Value of Money is widely connected to Economic Equivalence

Categories of Time Value of Money

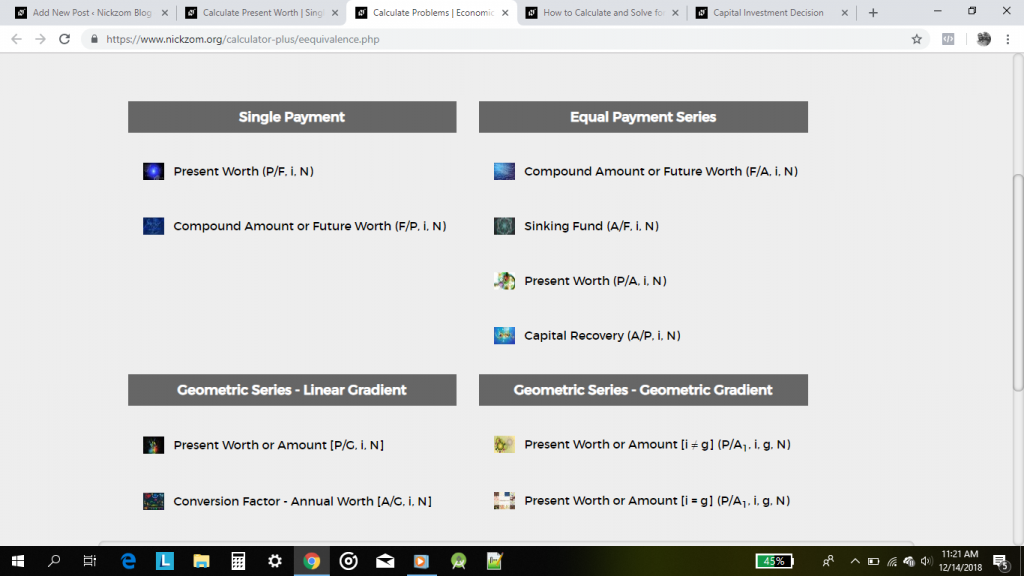

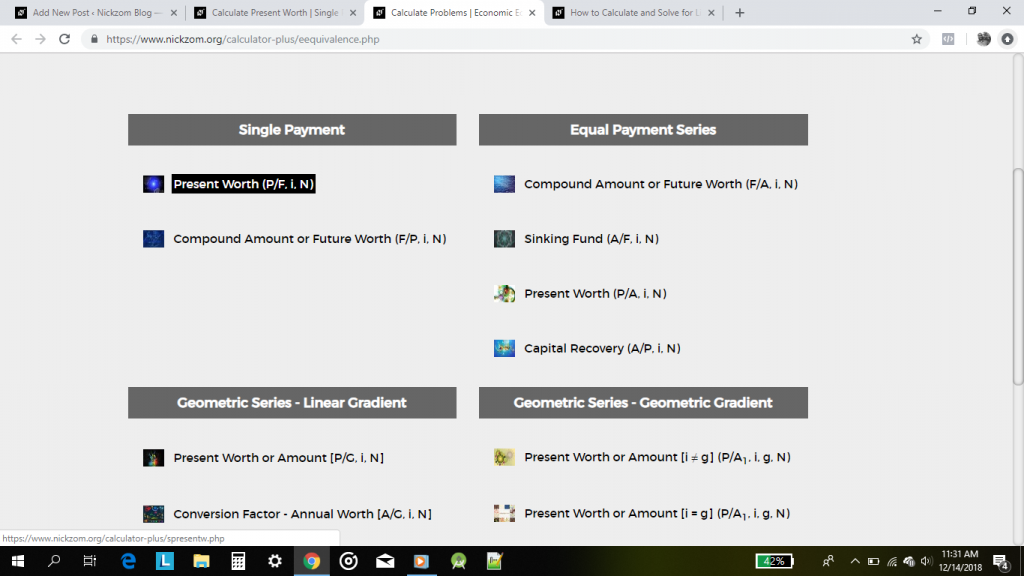

The time value of money can be categorized into four broad sections which are:

- Single Payment

- Present Worth

- Compound Amount or Future Worth

- Equal Payment Series

- Compound Amount or Future Worth

- Sinking Fund

- Present Worth

- Capital Recovery

- Geometric Series – Linear Gradient

- Present Worth or Amount

- Conversion Factor – Annual Worth

- Geometric Series – Geometric Gradient

- Present Worth or Amount

We would run an example with one of these categories.

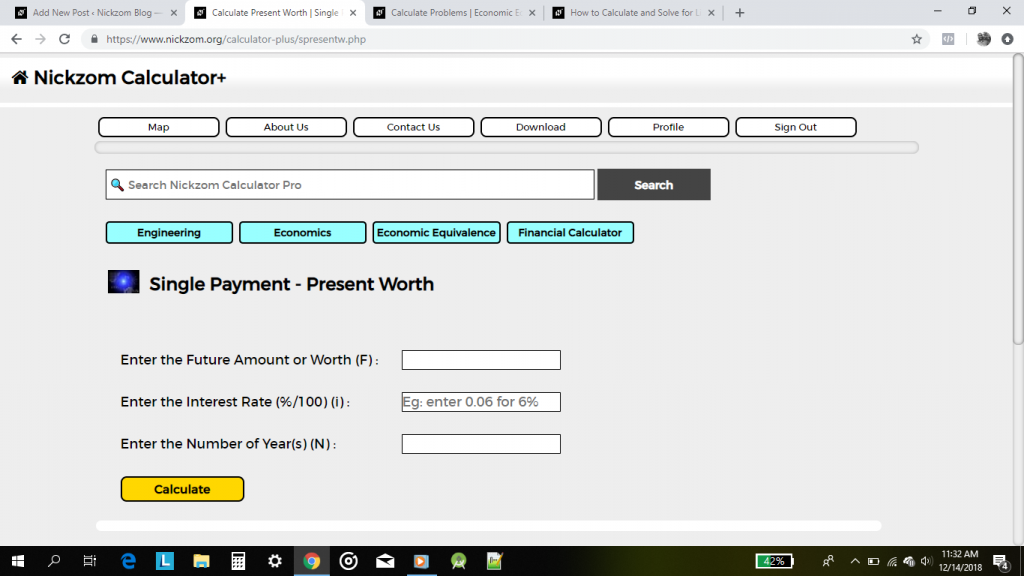

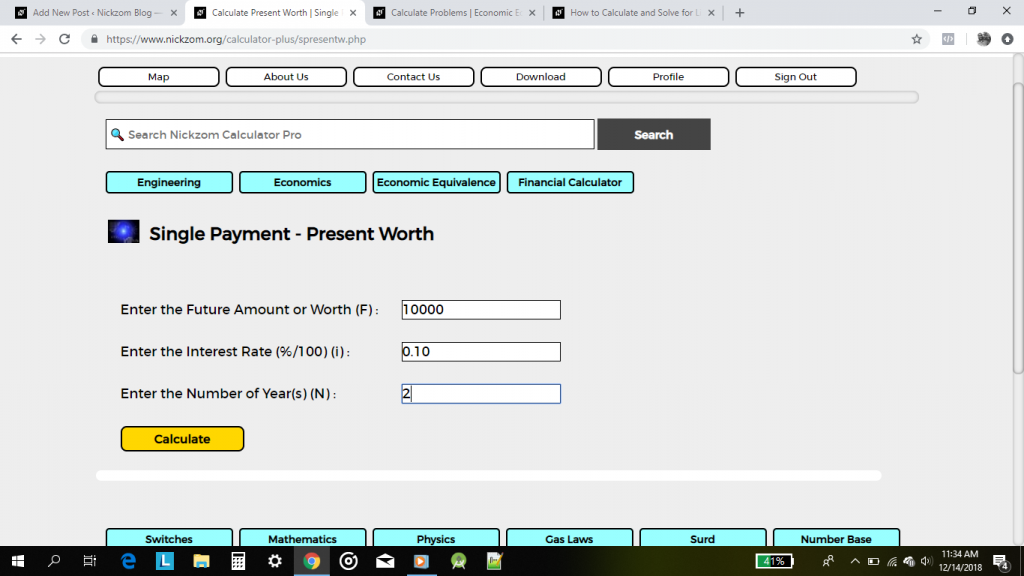

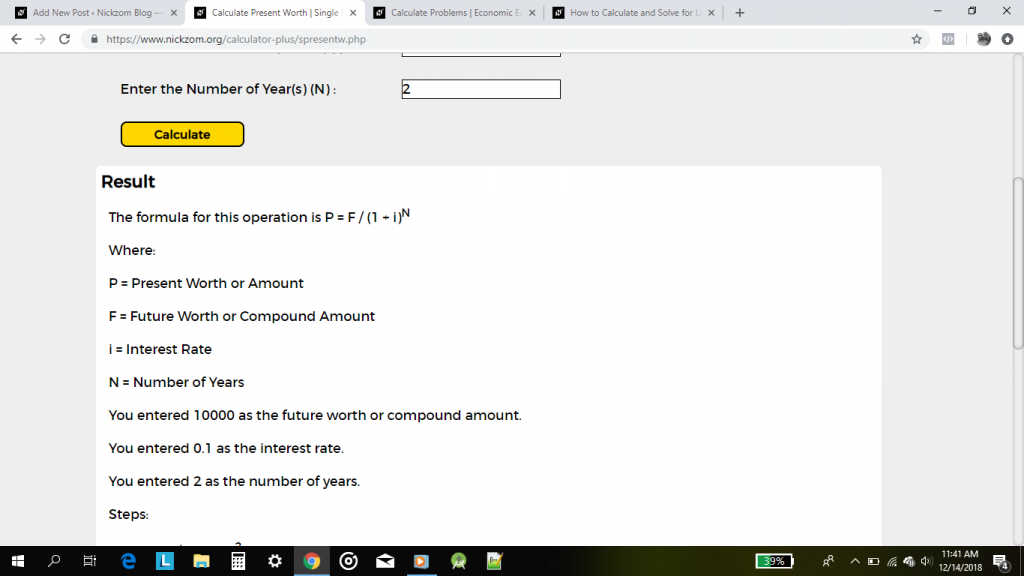

For Example: What is the single payment, present worth where the future worth or amount is $10,000, interest rate is 10% for 2 years.

The formula for calculating the present worth or amount at single payment:

P = F / (1 + i)N

Where

P = Present Worth or Amount

F = Future Worth or Amount

i = Interest Rate

N = Number of Years

Master Calculations Instantly

Unlock solutions for math, physics, engineering, and chemistry problem with step-by-step clarity. No internet required. Just knowledge at your fingertips, anytime, anywhere.

From the example,

The future worth or Amount (F) = $10,000

Interest Rate (i) = 10% = 10 / 100 = 0.1

Number of Years = 2

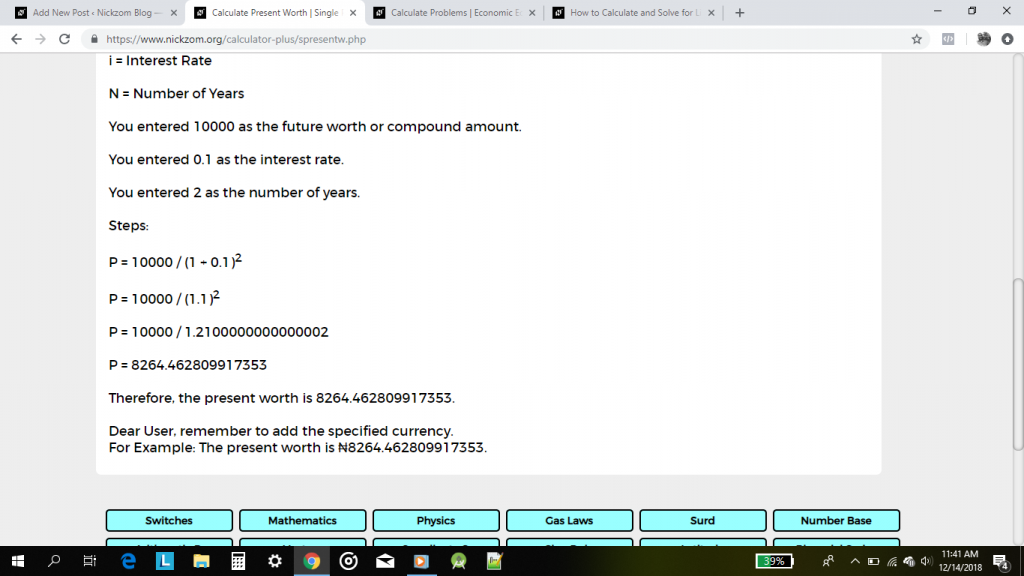

P = 10000 / (1 + 0.1)2

P = 10000 / 1.12

So, P = 10000 / 1.21

Then, P = 8264.46

Therefore, the present worth or amount is $8,264.46.

Using Nickzom Calculator, click on Time Value of Money on the Capital Investment Decision page.

Then, click on Present Worth under Single Payment.

A page is then displayed for you showing the parameters to compute the present worth or amount.

Now, enter the values for the parameters accordingly.

Lastly, click on the Calculate button

There are a lot of other applications of calculations for getting information with regards to the time value of money. One can use economic equivalence wisely in all its entirety to make comparison and aid make better and more efficient decisions most especially in capital investments.