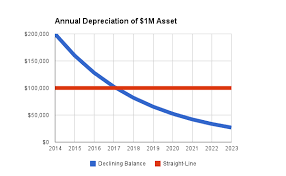

The image above represents annual depreciation. To calculate annual depreciation, four essential parameters are needed and these parameters are Original Cost (Co), Remaining Years of the Asset Useful Life beginning from the Last Year of its Life (R1), Salvage Value or Scrap Value (SV) and Sum of the Years Digit (SoVD).

The formula for calculating annual depreciation:

AD = R1(Co – SV) / SoVD

Where:

AD = Annual Depreciation

Co = Original Cost

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life

SV = Salvage Value or Scrap Value

SoVD = Sum of the Years Digit

Let’s solve an example;

Find the annual depreciation when the original cost is 28, the remaining years of the asset useful life beginning from the last year of its life is 18, the salvage value or scrap value is 14 and the sum of the years digit is 22.

This implies that;

Co = Original Cost = 28

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life = 18

SV = Salvage Value or Scrap Value = 14

SoVD = Sum of the Years Digit = 22

AD = R1(Co – SV) / SoVD

AD = 18(28 – 14) / 22

That is, AD = 18(14) / 22

AD = 252 / 22

AD = 11.45

Therefore, the annual depreciation is 11.45.

Calculating the Original Cost when the Annual Depreciation, the Remaining Years of the Asset Useful Life Beginning from the Last Year of its Life, the Salvage Value or Scrap Value and the Sum of the Years Digit are Given

Co = (AD x SoVD / R1) + SV

Where;

Co = Original Cost

AD = Annual Depreciation

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life

SV = Salvage Value or Scrap Value

SoVD = Sum of the Years Digit

Let’s solve an example;

Find the original cost when the annual depreciation is 10, the remaining years of the asset useful life beginning from the last year of its life is 4, the salvage value or scrap value is 8 and the sum of the years digit is 2.

This implies that;

AD = Annual Depreciation = 10

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life = 4

SV = Salvage Value or Scrap Value = 8

SoVD = Sum of the Years Digit = 2

Co = (AD x SoVD / R1) + SV

Co = (10 x 2 / 4) + 8

So, Co = (20 / 4) + 8

Co = 5 + 8

Co = 13

Therefore, the original cost is 13.

Read more: How to Calculate and Solve for Piston Displacement | Irrigation Water Requirement

Calculating the Remaining Years of the Asset Useful Life Beginning from the Last Year of its Life when the Annual Depreciation, the Original Cost, the Salvage Value or Scrap Value and the Sum of the Years Digit are Given

R1 = AD x SoVD / (Co – SV)

Where;

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life

AD = Annual Depreciation

Co = Original Cost

SV = Salvage Value or Scrap Value

SoVD = Sum of the Years Digit

Let’s solve an example;

Find the remaining years of the asset useful life beginning from the last year of its life when the annual depreciation is 15, the original cost is 10, the salvage value or scrap value is 6 and the sum of the years digit is 3.

This implies that;

AD = Annual Depreciation = 15

Co = Original Cost = 10

SV = Salvage Value or Scrap Value = 6

SoVD = Sum of the Years Digit = 3

R1 = AD x SoVD / (Co – SV)

So, R1 = 15 x 3 / (10 – 6)

R1 = 45 / 4

R1 = 11.25

Therefore, the remaining years of the asset useful life beginning from the last year of its life is 11.25.

Read more: How to Calculate and Solve for Depreciation Value | Declining Balance Method | Depreciation

Calculating the Salvage Value or Scrap Value when the Annual Depreciation, the Remaining Years of the Asset Useful Life Beginning from the Last Year of its Life, the Original Cost and the Sum of the Years Digit are Given

SV = Co – (AD x SoVD / R1)

Where;

Master Calculations Instantly

Unlock solutions for math, physics, engineering, and chemistry problem with step-by-step clarity. No internet required. Just knowledge at your fingertips, anytime, anywhere.

SV = Salvage Value or Scrap Value

AD = Annual Depreciation

Co = Original Cost

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life

SoVD = Sum of the Years Digit

Let’s solve an example;

Find the salvage value or scrap value when the annual depreciation is 21, the original cost is 14, the remaining years of the asset useful life beginning from the last year of its life is 18 and the sum of the years digit is 9.

This implies that;

AD = Annual Depreciation = 21

Co = Original Cost = 14

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life = 18

SoVD = Sum of the Years Digit = 9

SV = Co – (AD x SoVD / R1)

SV = 14 – (21 x 9 / 18)

Then, SV = 14 – (189 / 18)

SV = 14 – 10.25

SV = 3.75

Therefore, the salvage value or scrap value is 3.75.

Read more: How to Calculate and Solve for Total Load on Flexible Pipe | Irrigation Water Requirement

Calculating the Sum of the Years Digit when the Annual Depreciation, the Remaining Years of the Asset Useful Life Beginning from the Last Year of its Life, the Salvage Value or Scrap Value and the Original Cost are Given

SoVD = R1 (Co – SV) / AD

Where;

SoVD = Sum of the Years Digit

AD = Annual Depreciation

Co = Original Cost

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life

SV = Salvage Value or Scrap Value

Let’s solve an example;

Find the sum of the years digit when the annual depreciation is 24, the original cost is 12, the remaining years of the asset useful life beginning from the last year of its life is 10 and the salvage value or scrap value is 7.

This implies that;

AD = Annual Depreciation = 24

Co = Original Cost = 12

R1 = Remaining Years of the Asset Useful Life beginning from the Last Year of its Life = 10

SV = Salvage Value or Scrap Value = 7

SoVD = R1 (Co – SV) / AD

SoVD = 10 (12 – 7) / 24

That is, SoVD = 10 (5) / 24

SoVD = 50 / 24

SoVD = 2.083

Therefore, the sum of the years digit is 2.083.

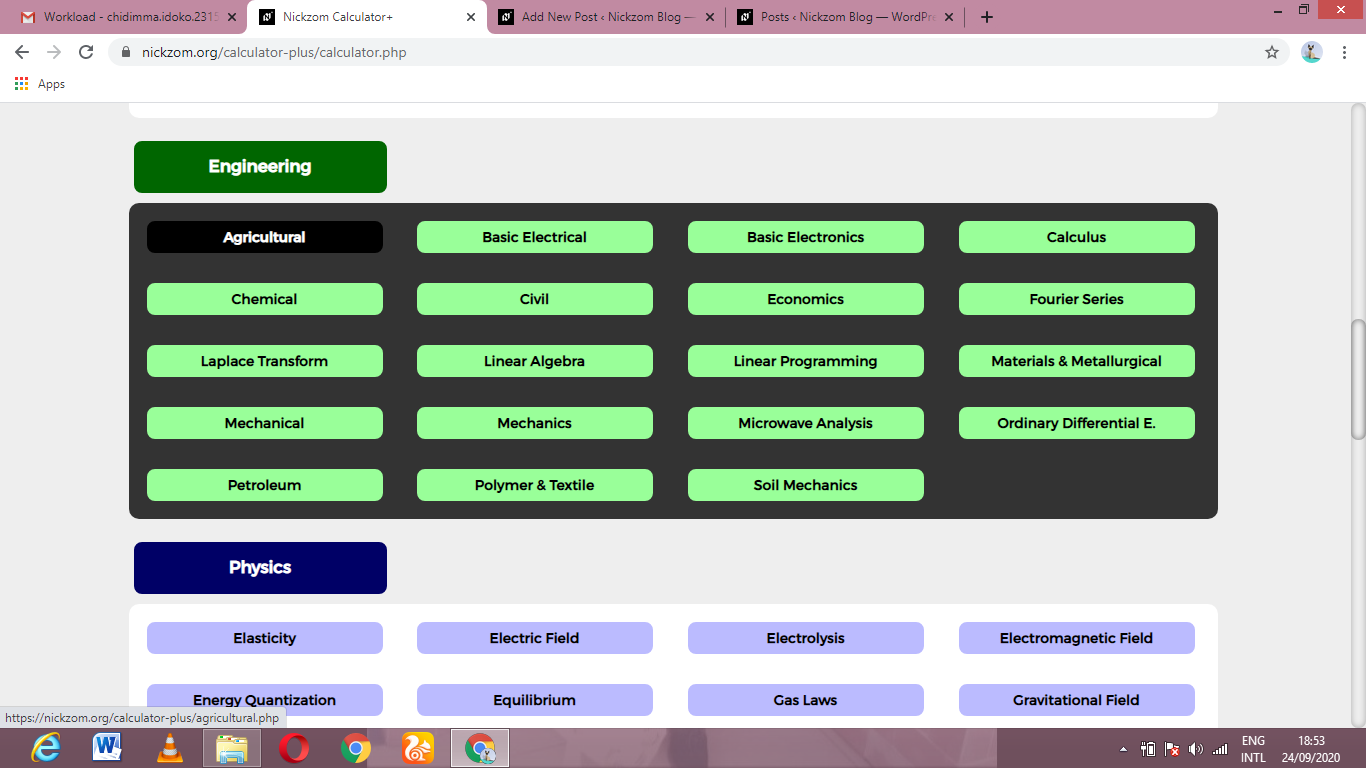

How to Calculate Annual Depreciation Using Nickzom Calculator

Nickzom Calculator – The Calculator Encyclopedia is capable of calculating the annual depreciation.

To get the answer and workings of the annual depreciation using the Nickzom Calculator – The Calculator Encyclopedia. First, you need to obtain the app.

You can get this app via any of these means:

Web – https://www.nickzom.org/calculator-plus

To get access to the professional version via web, you need to register and subscribe for NGN 2,000 per annum to have utter access to all functionalities.

You can also try the demo version via https://www.nickzom.org/calculator

Android (Paid) – https://play.google.com/store/apps/details?id=org.nickzom.nickzomcalculator

Android (Free) – https://play.google.com/store/apps/details?id=com.nickzom.nickzomcalculator

Apple (Paid) – https://itunes.apple.com/us/app/nickzom-calculator/id1331162702?mt=8

Once, you have obtained the calculator encyclopedia app, proceed to the Calculator Map, then click on Agricultural under Engineering.

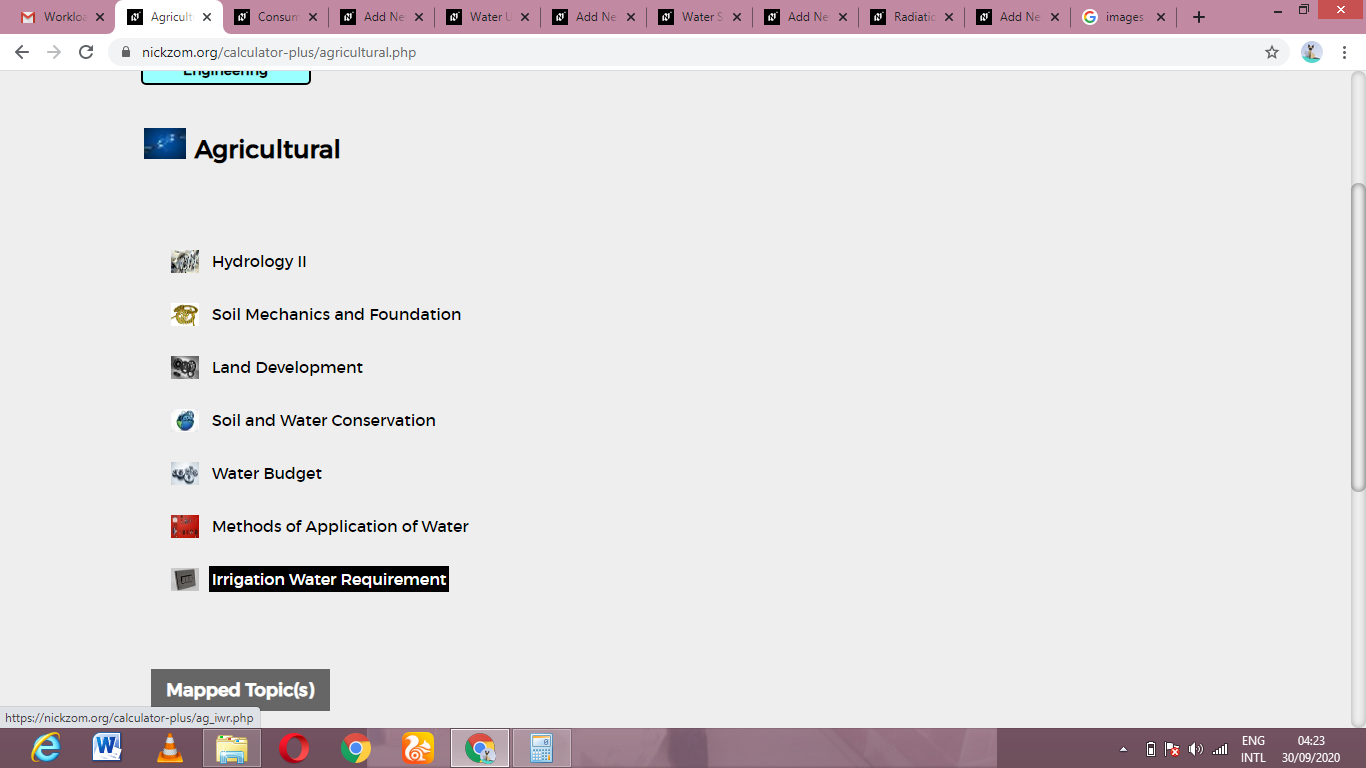

Now, Click on Irrigation Water Requirement under Agricultural

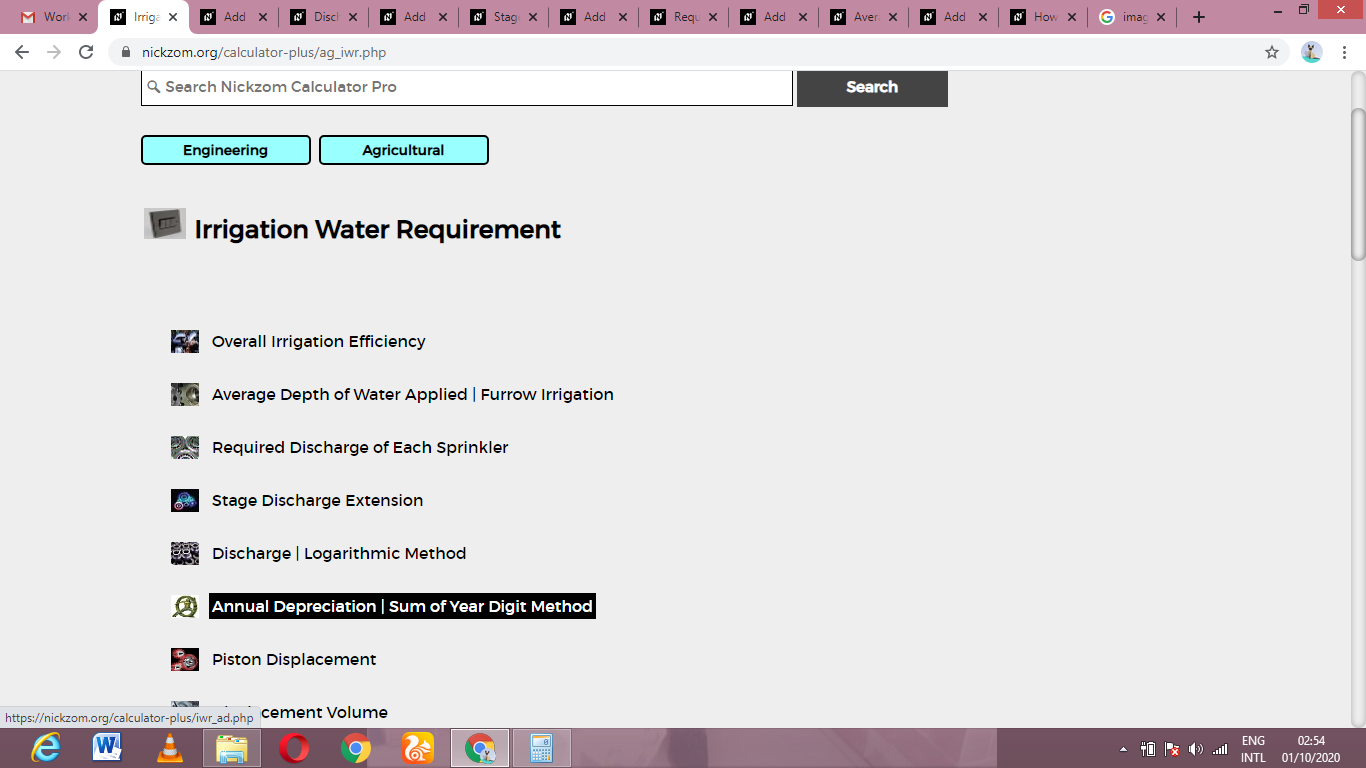

Now, Click on Annual Depreciation under Irrigation Water Requirement

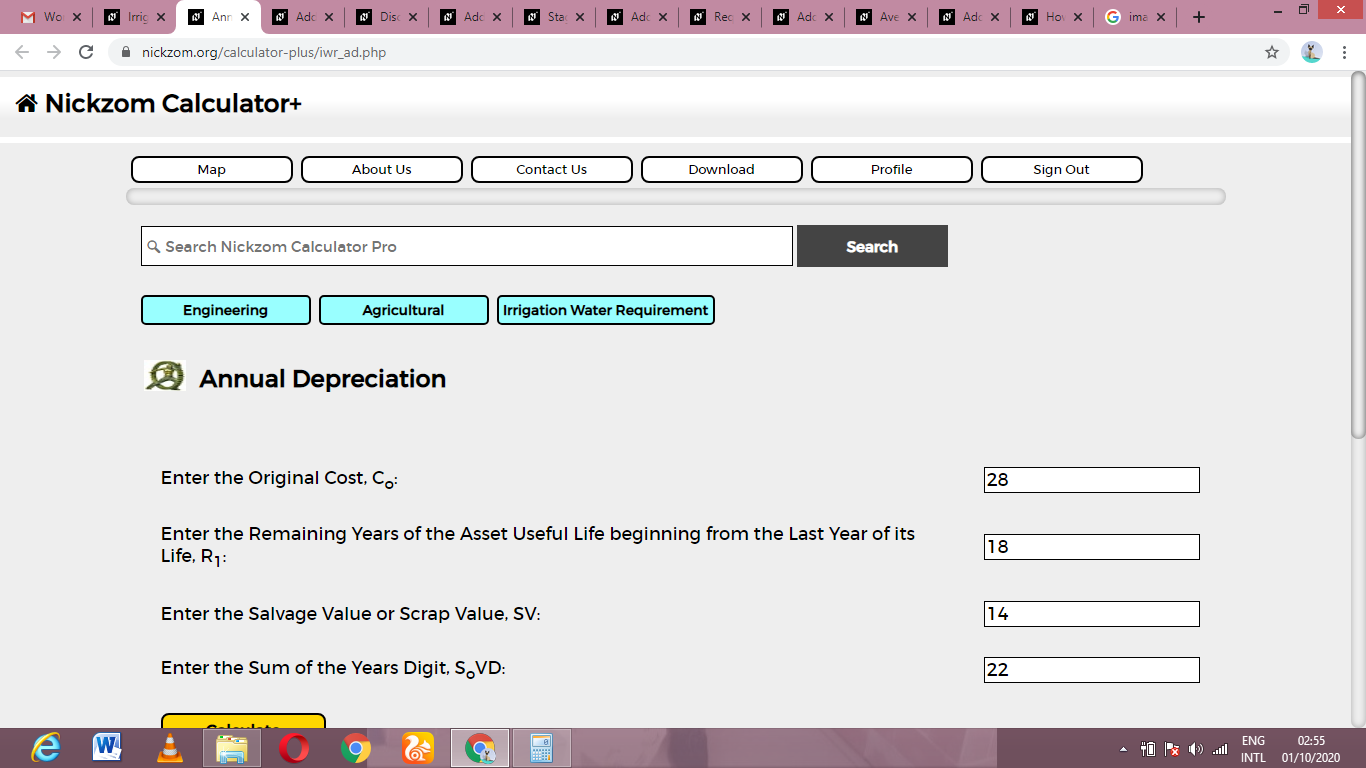

The screenshot below displays the page or activity to enter your values, to get the answer for the annual depreciation according to the respective parameters which is the Original Cost (Co), Remaining Years of the Asset Useful Life beginning from the Last Year of its Life (R1), Salvage Value or Scrap Value (SV) and Sum of the Years Digit (SoVD).

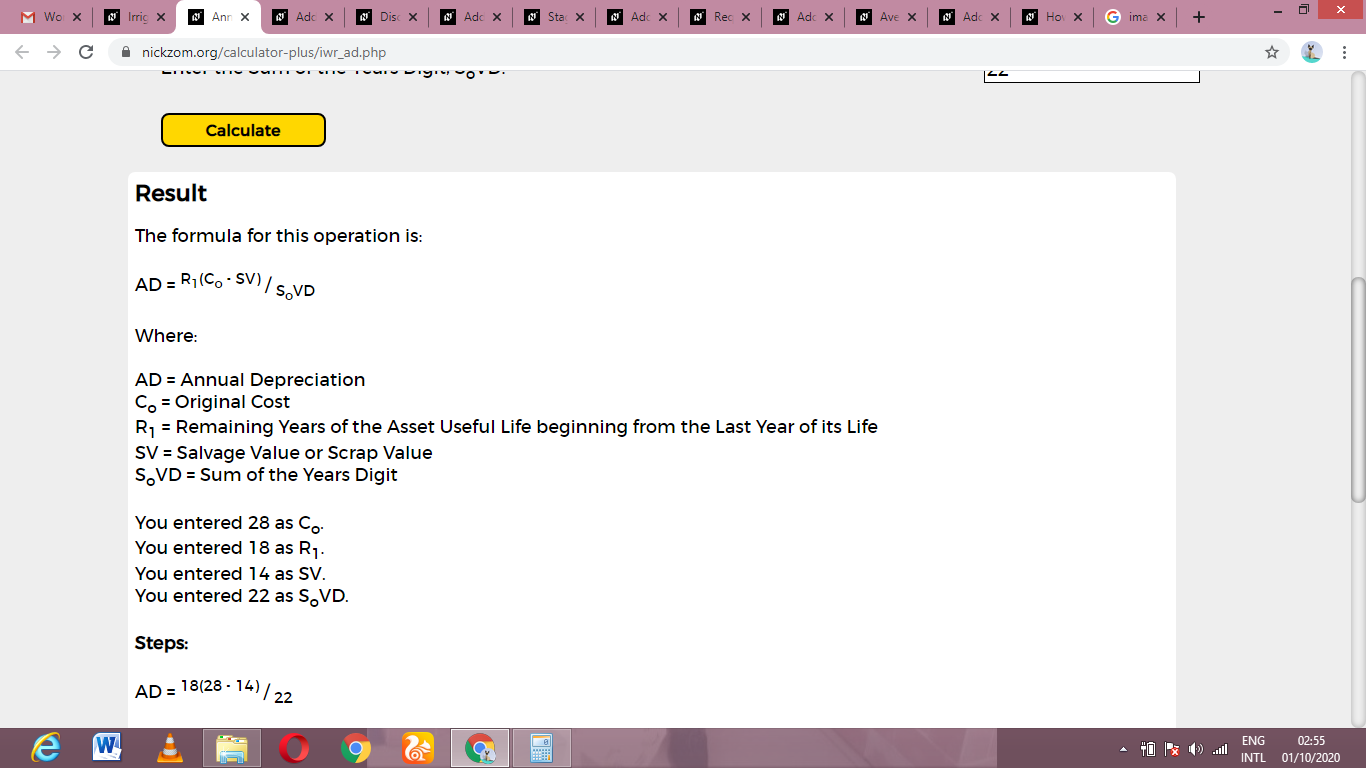

Now, enter the values appropriately and accordingly for the parameters as required by the Original Cost (Co) is 28, Remaining Years of the Asset Useful Life beginning from the Last Year of its Life (R1) is 18, Salvage Value or Scrap Value (SV) is 14 and Sum of the Years Digit (SoVD) is 22.

Master Calculations Instantly

Unlock solutions for math, physics, engineering, and chemistry problem with step-by-step clarity. No internet required. Just knowledge at your fingertips, anytime, anywhere.

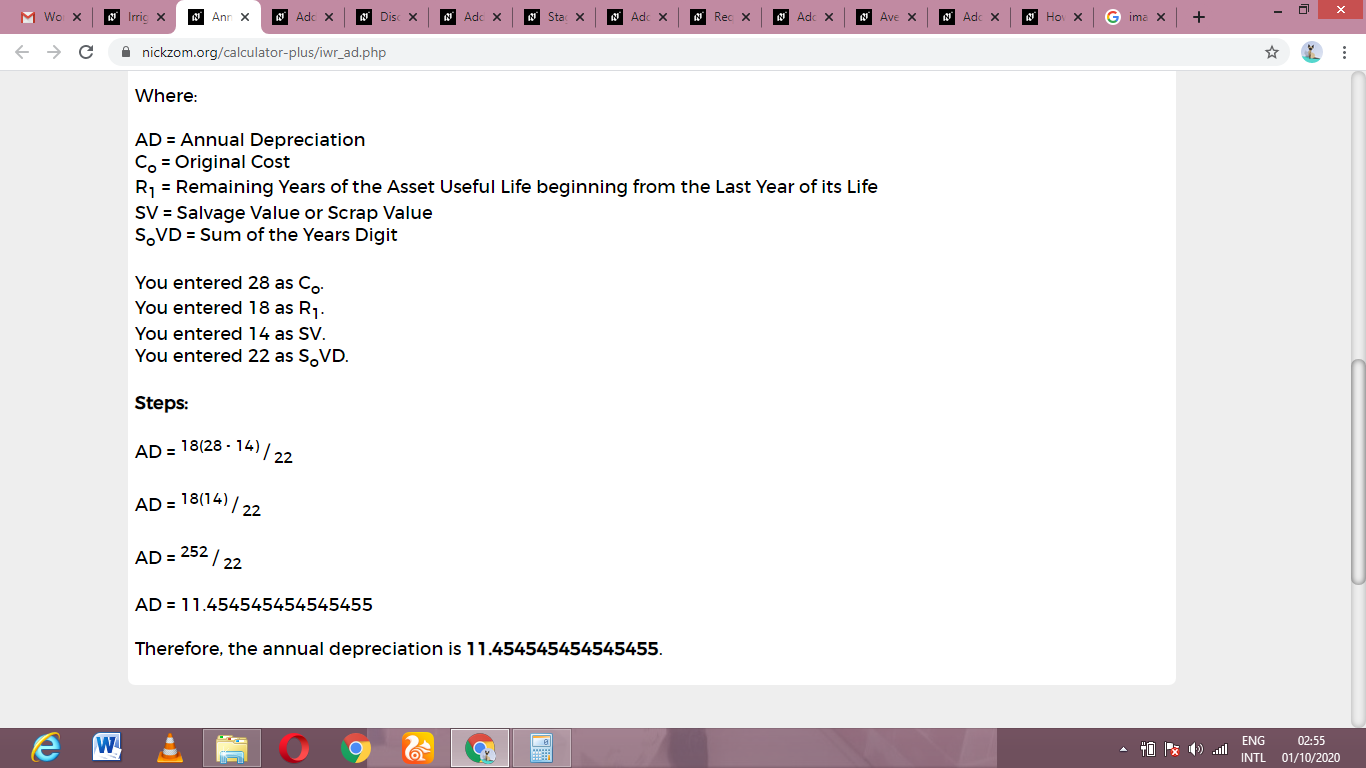

Finally, Click on Calculate

As you can see from the screenshot above, Nickzom Calculator– The Calculator Encyclopedia solves for the annual depreciation and presents the formula, workings and steps too.